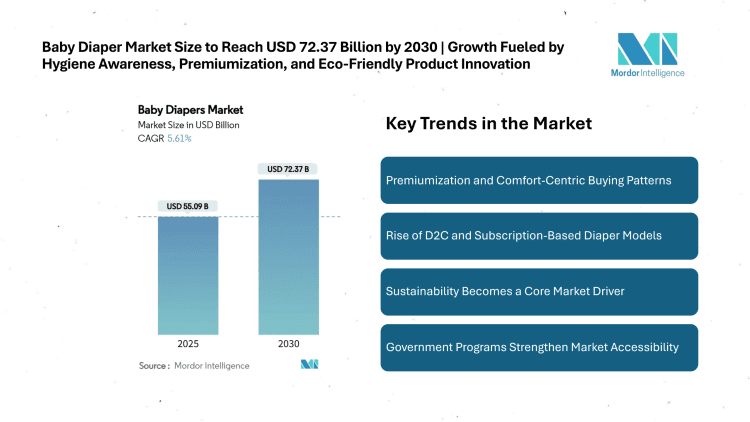

Introduction – Hygiene Awareness and Comfort Trends Drive the Global Baby Diaper Market Growth

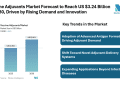

According to the Global Baby Diaper Market Report by Mordor Intelligence, the baby diaper market size is expected to grow from USD 55.09 billion in 2025 to USD 72.37 billion by 2030, registering a CAGR of 5.61% during the forecast period. This strong baby diaper market growth reflects a surge in infant hygiene awareness, rising disposable incomes, and demand for premium and eco-friendly diaper solutions.

Modern parents are increasingly choosing soft, breathable, and highly absorbent diapers that ensure comfort and skin safety. The widespread availability of disposable and sustainable diapers across supermarkets and online retail channels has accelerated market penetration. Furthermore, digital-first D2C (Direct-to-Consumer) models and technological innovations, such as dual-core absorption, organic materials, and biodegradable fibers, are transforming how brands engage with consumers globally.

Government initiatives in countries like Singapore, the United States, and Japan have also boosted diaper adoption by subsidizing infant care products, recognizing diapers as essential goods, and promoting hygiene awareness campaigns. The ongoing shift toward plant-based, compostable diapers underscores a global transition toward sustainable consumer behavior.

Get a Sample Report of Baby Diaper Market Forecast – https://www.mordorintelligence.com/industry-reports/baby-diapers-market?utm_source_emailwire

Key Trends – Evolving Consumer Behavior and Green Innovation Reshape the Baby Diaper Industry

1. Premiumization and Comfort-Centric Buying Patterns

The modern consumer base is prioritizing skin health, comfort, and safety over cost. Premium baby diapers offering organic cotton layers, breathable fabrics, and advanced absorbency systems are gaining traction. Companies like Procter & Gamble (Pampers) and Kimberly-Clark (Huggies) are investing in product differentiation to attract high-value customers despite fluctuating raw material prices.

Premiumization also enhances brand loyalty as parents prefer longer-lasting, odor-resistant, and dermatologically tested products. These developments indicate a steady shift from mass-market to value-added diaper categories.

2. Rise of D2C and Subscription-Based Diaper Models

The baby diaper market analysis highlights a surge in digital-first and D2C brands, enabling smaller eco-conscious players to reach customers directly through social media and e-commerce platforms. Subscription-based services, personalized diaper packs, and loyalty programs have improved customer retention and brand trust.

This trend favors online-native sustainable brands, which are leveraging influencer marketing and transparency in ingredient sourcing to differentiate themselves in a competitive landscape.

3. Sustainability Becomes a Core Market Driver

Growing awareness of environmental pollution from non-biodegradable diapers has fueled demand for eco-friendly, plant-based, and compostable alternatives. Innovations in bamboo fibers, organic cotton, and biodegradable SAP (Super Absorbent Polymers) are reshaping manufacturing practices. Regulatory frameworks in the EU, Japan, and the U.S. are encouraging companies to transition toward low-carbon, recyclable packaging and green production lines, positioning sustainability as a primary competitive advantage.

4. Government Programs Strengthen Market Accessibility

Government-funded programs for infant care essentials, such as in Singapore, South Korea, and the U.S., are helping bridge affordability gaps. Public health campaigns promoting diaper hygiene also reduce infection rates, driving consistent consumption even in regions with low birth rates. By recognizing diapers as essential hygiene products, governments are improving both infant welfare and consumer access.

Read the full report and access market snapshots that include both global views and Japan-specific analysis – https://www.mordorintelligence.com/ja/industry-reports/baby-diapers-market?utm_source_emailwire

Market Segmentation – Product Diversity and Regional Adoption Patterns

The baby diaper market segmentation covers a range of product types, materials, and distribution models catering to distinct consumer needs and regional preferences.

By Product Type

- Disposable Diapers – Leading the segment due to convenience, hygiene, and wide availability..

- Cloth Diapers – Preferred by environmentally aware and budget-focused parents..

- Biodegradable Diapers – Fastest-growing category due to sustainability awareness.

By Style

- Pant/Pull-Up Diapers – Gaining adoption among toddlers for easy wearing and mobility.

- Taped Diapers – Ideal for newborns, offering secure fit and superior leakage control.

By Absorbency Technology

- Standard SAP Core – Provides cost-effective and consistent absorbency.

- Dual-Core/Channel Systems – Improve fluid distribution, dryness, and comfort during long wear.

By Material Type

- Cotton – Dominates for its softness and natural breathability.

- Blended Fabrics – Combine synthetic durability with organic comfort.

- Bamboo and Plant-Based Materials – Rapidly expanding due to eco-appeal and biodegradability.

By Distribution Channel

- Supermarkets & Hypermarkets – Continue to lead sales through high visibility and convenience.

- Online Retail & D2C Platforms – Fastest-growing segment, fueled by digital marketing and subscription services.

- Pharmacy & Grocery Stores – Retain consistent consumer trust and repeat purchases.

By Geography

- Asia-Pacific – Largest market, driven by rising birth rates and disposable incomes in India, China, and Indonesia.

- North America – Focused on premium and organic product categories.

- Europe – Leading in biodegradable and regulatory-compliant diapers.

- South America & Middle East/Africa – Emerging markets supported by urbanization and economic growth.

Key Players – Market Leaders and Emerging Innovators

The global baby diaper industry is moderately consolidated, with major brands and regional players expanding portfolios through innovation and sustainability strategies.

Prominent companies include:

- Procter & Gamble Company (Pampers)

- Kimberly-Clark Corporation (Huggies)

- Kao Corporation (Merries)

- Unicharm Corporation (Moony)

- Ontex Group NV

Recent advancements include Ontex’s 360° Leak Protection System, tree-free diapers by Swara Baby Products, and plant-based designs from Soft N Dry Diapers Corp. Smaller, eco-focused entrants are using transparency, online engagement, and direct distribution to challenge established players. Meanwhile, global leaders are enhancing ESG commitments, reducing carbon emissions, and adopting biodegradable SAP technologies to strengthen brand positioning.

Conclusion – Sustainability and Digital Transformation Define the Future Outlook

The global baby diaper market is transitioning toward a sustainable, premium, and digitally driven ecosystem. With rising parental awareness, eco-friendly preferences, and the growth of e-commerce channels, the market is set for continued expansion through 2030.

Future leaders will focus on:

- Sustainable sourcing and biodegradable materials

- Digital-first consumer engagement

- Affordable innovation and inclusive accessibility

As the baby diaper market size grows steadily, companies that prioritize transparency, innovation, and environmental responsibility are expected to capture the trust of modern parents and achieve long-term brand loyalty.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/